iowa city homestead tax credit

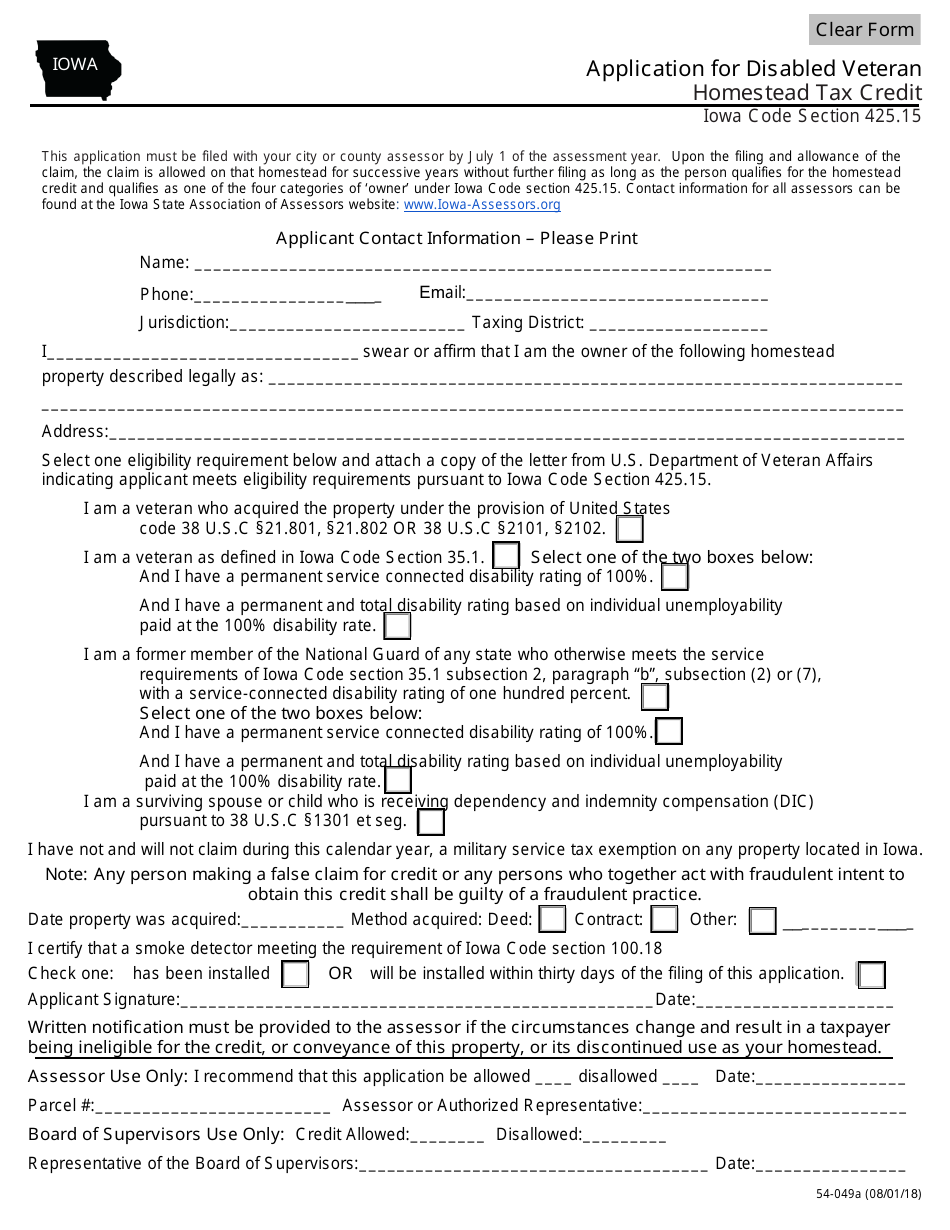

It is a onetime only sign up as long as you occupy the home. Iowa City IA 52240 The Homestead Credit is available to all homeowners who own and occupy the residence.

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Economics Project

Instructions for Homestead Application You must print sign and mail this application to.

. When it comes to the homestead exemption its up to you to take the initiative. Application for Homestead Tax Credit Iowa Code Section 425. In the state of Iowa this portion is the first 4850 of your propertys net taxable value.

Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. To qualify you must live in the Iowa property you own for 6 months of the year be an Iowa resident and live in the home on July 1. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding.

File With Confidence Today. Originally adopted to encourage home ownership through property tax relief. Please contact us at 356-6066 if you have received a notification of our visit or if you have any questions.

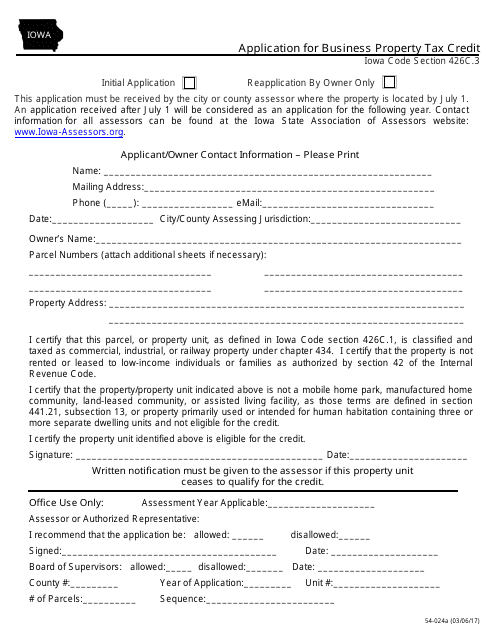

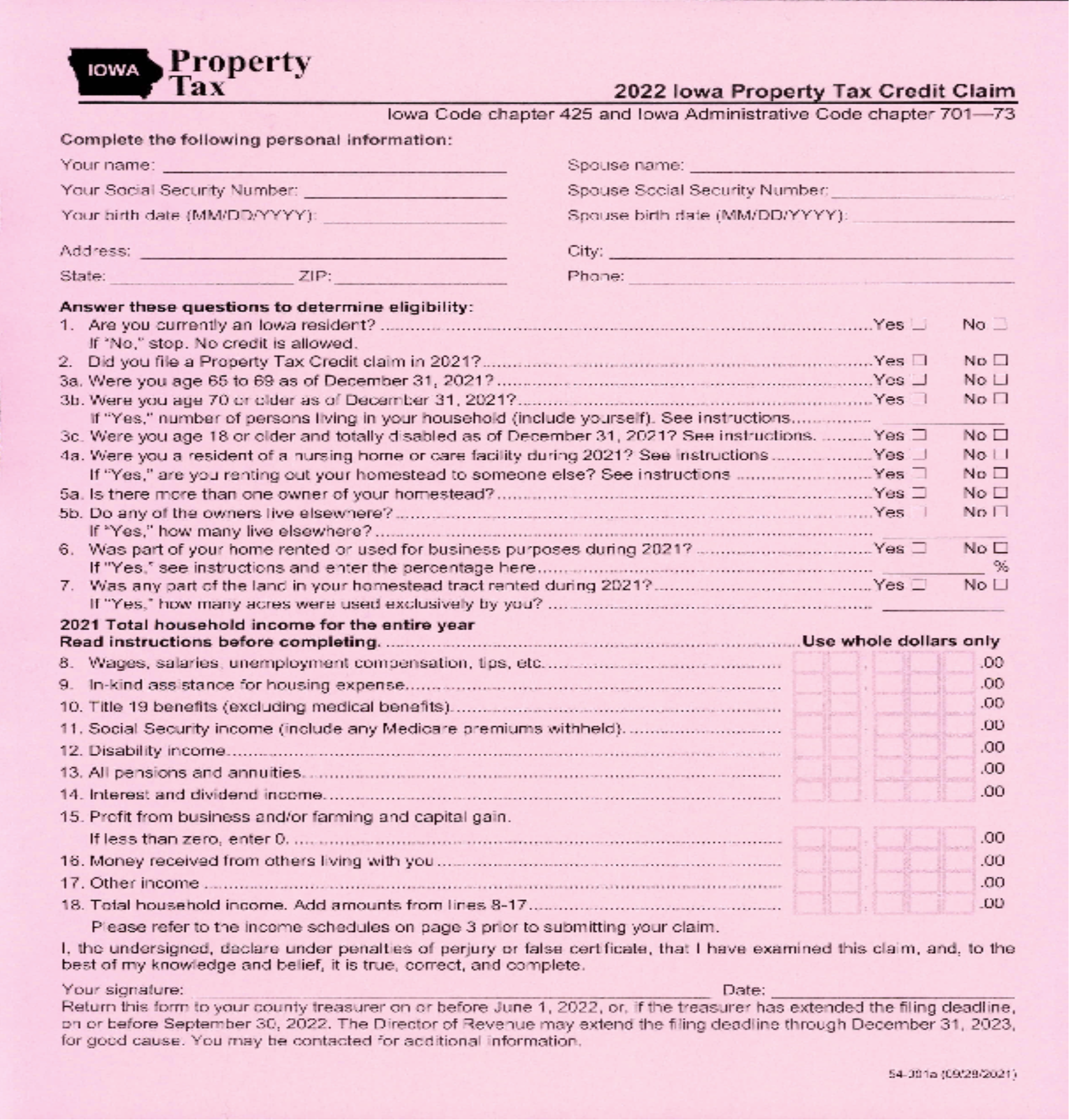

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. 2022 Iowa Property Tax Credit Claim page 5. One time filing is provided by statute unless the property owner is 1 filing for Homestead Credit Military Exemption or Business Property Tax Credit for the first time.

How the Homestead Exemption Works. What is the Credit. Youll need to scroll down to find the link for the Homestead Tax Credit Application.

IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. The current credit is equal to the actual tax levy on the first 4850 of actual value. Upon filing and allowance of the claim the claim is allowed on that.

It must be postmarked by July 1. A claimant filing a claim for the property tax credit who is at least 70 years of age and who has a household income of less than 250 percent of the federal poverty level is eligible to receive a credit against property taxes due on the claimants. This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount.

913 S Dubuque St. Iowa Code Section 425. January 1 through December 31 - Period for filing for Homestead Credit Military Exemption and Business Property Tax Credit.

Answer Simple Questions About Your Life And We Do The Rest. If you havent youre spending more than you need to on your p. Learn About Sales.

If you owned another home prior to this please notify us of the address so we can remove the credit. Have you applied for your homestead tax credit. Application for Homestead Tax Credit.

To qualify for the credit the property owner must be a resident of. Iowa Homestead Tax Credit Johnson County Dubuque st suite 217 iowa city iowa 52240. Attention homeowners in Johnson County Iowa.

Adopted and Filed Rules. Learn About Property Tax. Refer to Code of Iowa Chapter 425.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed.

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. It is a onetime only sign up and is valid for as long as you own and occupy the home. Iowa homestead tax credit formNotice of transfer or change in use of property claimed for homestead tax credit or military service tax exemption iowa code sections 42522 and 426a133 and iowa administrative code rule 7018011a this notice must be filed or mailed to your city or county assessor by july 1 following the date of transfer or change in use.

NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. Applications can be completed at our office or obtained online by clicking on Additional Information Links above and then the Iowa City Assessor Page.

Upon filing and allowance of the claim the claim is allowed on that. Iowa Homestead Credit Description. Law.

2 has purchased a new or used home and is occupying the property as a homestead as. 54-001e 09282021 TREASURERS USE ONLY. What is a Homestead Tax Credit.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first. The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the homestead tax credit application. The current credit is equal to the actual tax levy on.

Fill in all yellow highlighted areas. Persons in the military or nursing homes who do not occupy the home are also eligible. It must be postmarked by July 1.

No Tax Knowledge Needed. The military tax credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or iowa national guard who served at least 20 years qualify for this exemption. The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the homestead tax credit application.

Tax Credits. It must be postmarked by July 1. Iowa City Assessor.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. File a W-2 or 1099. 52240 The Homestead Credit is available to all homeowners who own and occupy the.

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. The Homestead Tax Credit is a small tax break for homeowners on their primary residence.

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

Iowa Estate Tax Everything You Need To Know Smartasset

Iowa Estate Tax Everything You Need To Know Smartasset

The Edgar Backus Schermerhorn House In Galena Kansas Was Built Circa 1895 For Edgar Backus Schermerhorn A Wealthy Unique Buildings Vintage Architecture House

Agriculture Clouds Corn Country Dirt Road Farm Fields Hdr Iowa Landscape Nature Outdoors Rural Sky Sunset Homesteading City Landscape Iowa

Our Armstrong Feed Mill Otter Co Op Farm Visit Penticton Kelowna

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Property Tax Relief Polk County Iowa

Property Taxes Marion County Iowa

Bankruptcy Exempt Property In Florida Ayo And Iken Bankruptcy Insurance Benefits Life Insurance Policy

In Order To Be A Better Prepper You Must Do Hard Things Prepper You Must Best

Millions Of Acres Advertisement 1872 Idca

Crossing The Line A History Of Medical Inspection At The Border Mexican Border Border Iowa City

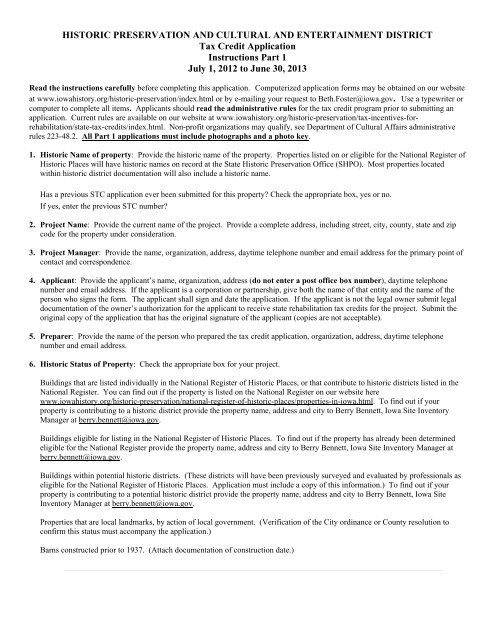

Iowa Property Tax Credit Certification Application State Historical

Iowa Estate Tax Everything You Need To Know Smartasset

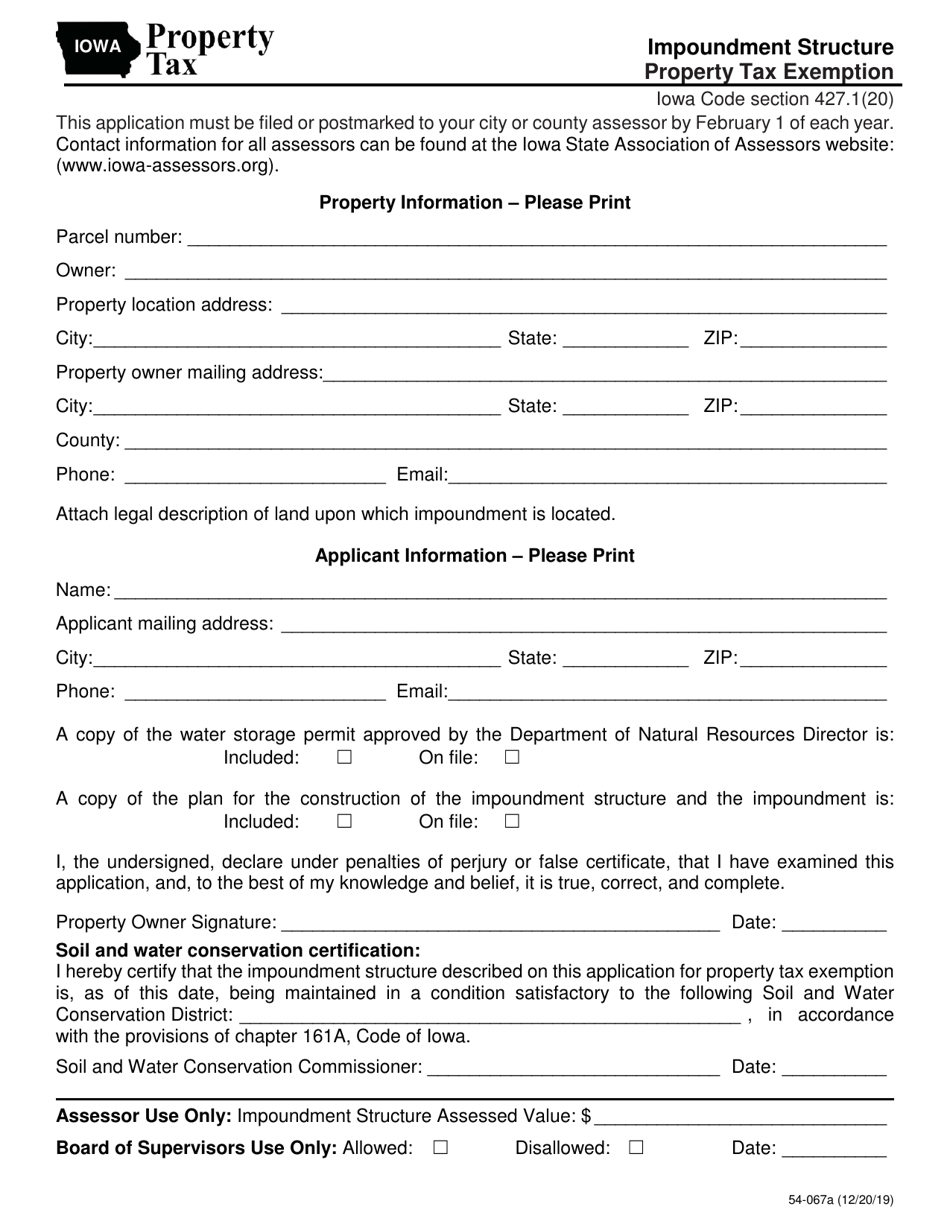

Form 54 067 Download Printable Pdf Or Fill Online Impoundment Structure Property Tax Exemption Iowa Templateroller