will child tax credit monthly payments continue in 2022

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Families Won T See Child Tax Credit Payments For First Time In Six Months

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. From january to december 2022 taxpayers will continue to receive the advanced child tax credit payments as usual. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

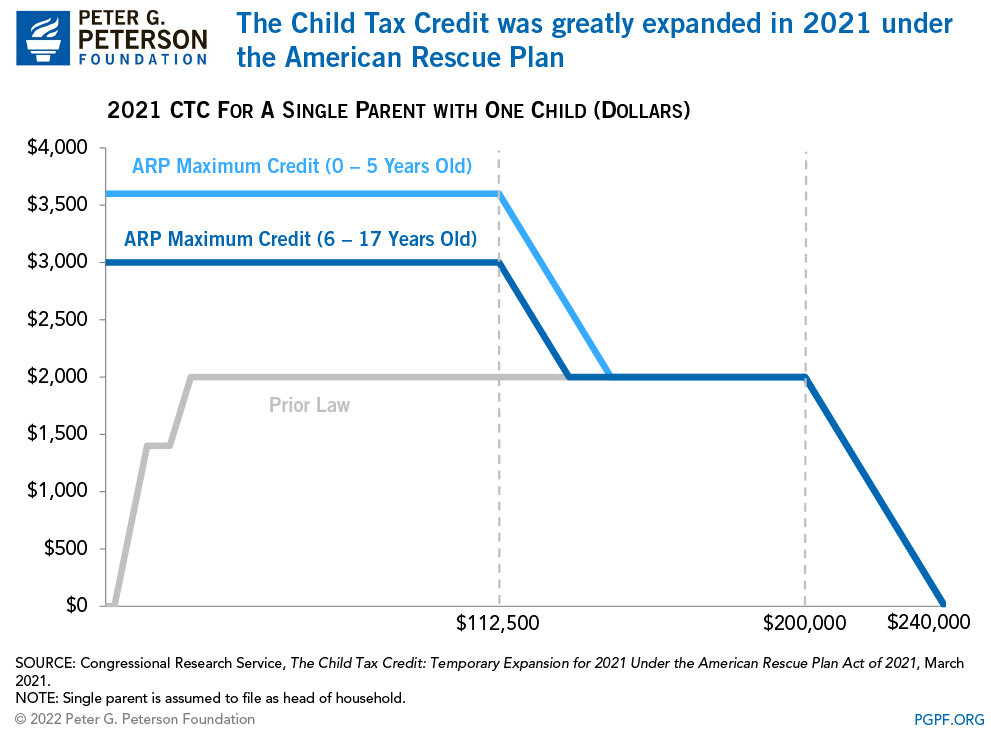

Families who are eligible for the expanded credit may see more money come to them when they file their taxes this year as just half of the total. 15 Democratic leaders in Congress are working to. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Will there be a child tax credit in February 2022. Child support continues until the child is 18.

You will receive either 250 or 300 depending on the age of. Those returns would have information like income filing status and how many children are. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those returns would have information like income filing status and how many children are.

Thats because only half the money came via the monthly installments. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Thats because only half the money came via the monthly installments. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

If the child turns 18 and is attending high-school child support continues until June 30 of the school year when the child becomes 18.

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Stimulus Update There May Still Be Hope For Monthly Child Tax Credit Payments In 2022 Here S Why

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Here Are 9 Things To Know For 2022 About Changes To Your 401k Child Tax Credit Social Security Nj Com

Child Tax Credit Will Monthly Payments Continue Into 2022 Gobankingrates

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How The Child Tax Credit Originated And The Future Of The Child Tax Credit Forbes Advisor

Child Tax Credit Will Monthly Payments Continue In 2022 11alive Com

Tax Season What You Need To Know To Claim The Child Tax Credit

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit 2022 These 14 States Offer Their Own Child Tax Credit

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Americans Are Eager For More Monthly Child Tax Credit Checks Future Payments Could Come With Work Requirements