does personal cash app report to irs

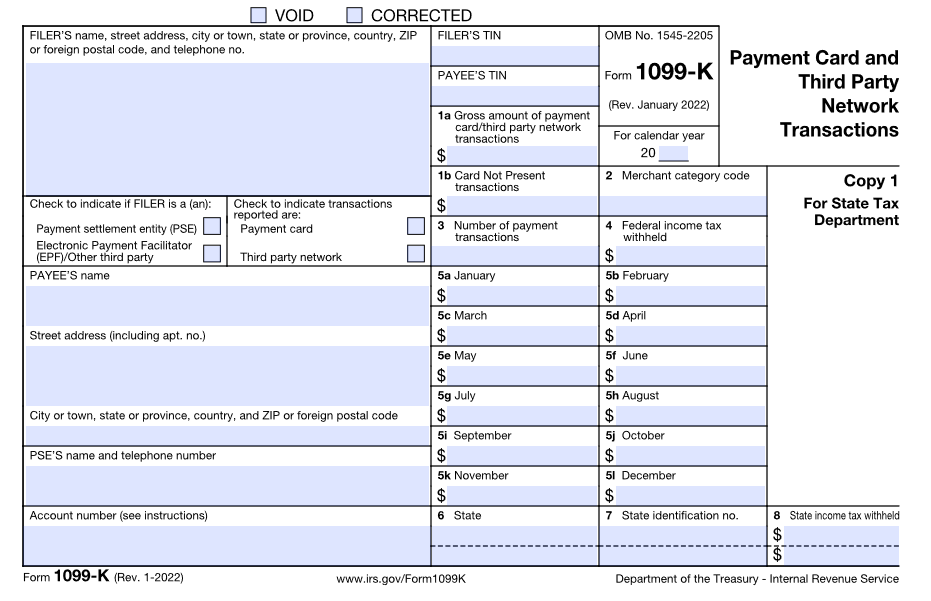

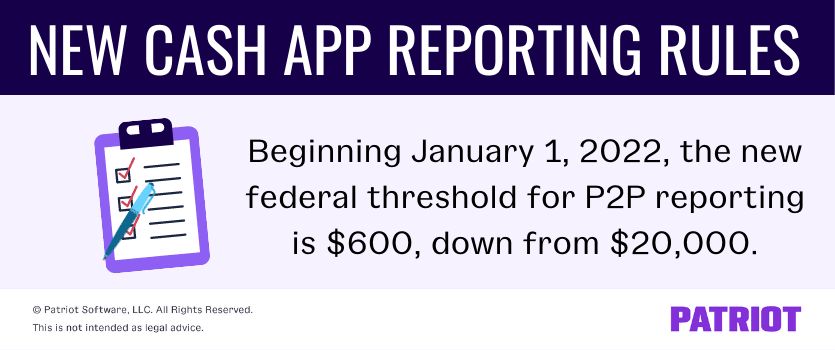

Web Payments for goods and services totaling 600 or more in a year must be reported on Form 1099-K starting January 1 2022. Web A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their.

New Irs Tax Rules Will Affect Cash App Users What You Need To Kn Wcnc Com

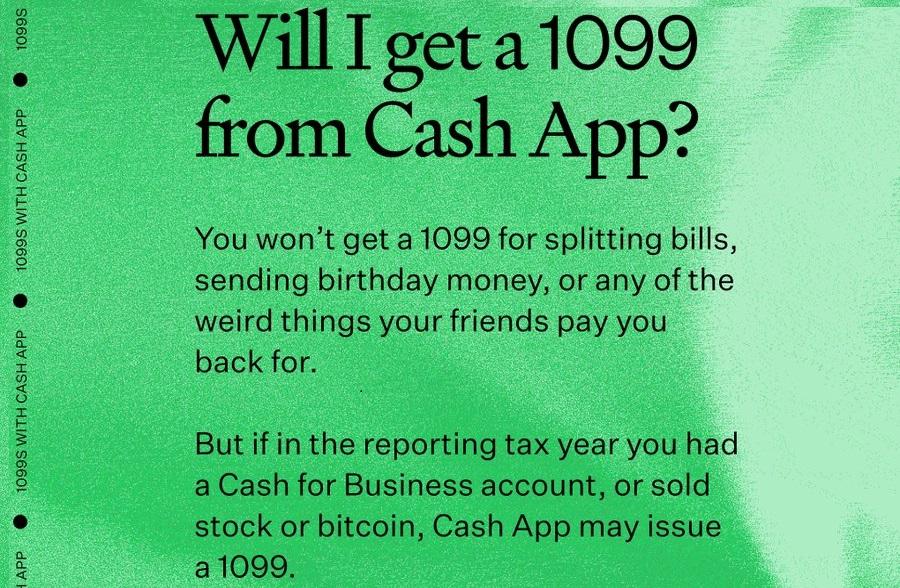

As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19892770/Cash_App___Dollar___Full.jpg)

. Personal Cash App accounts are. Now cash apps are required to report payments totaling more than 600 for goods and. In one lump sum.

If you have a standard non-business. Web Beginning this year third-party payment processors will be required to report a users business transactions to the IRS if they exceed 600 for the year. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year.

There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. Web What Are the New Rules to Report Cash App Payments. In two or more related payments within 24 hours.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Web What is the Irs Cash App Law. Web Starting Jan.

Web However the American Rescue Plan made changes to these regulations. As part of a single transaction. Web Form 1099-K is used to report transactions for the sale of goods andor services through peer-to-peer P2P payment services like Cash App.

Web New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report. Web A person must report cash of more than 10000 they received.

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Irs Tax Reporting Changes Coming To Apps Like Venmo Zelle

Does Cash App Report To The Irs

Clarifications And Complexities Of The New 1099 K Reporting Requirements

Does Cash App Report To The Irs

Does Cash App Report Your Personal Account To Irs

Can You Track Your Cash App Card Is Cash App Traceable Frugal Living Personal Finance Blog

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

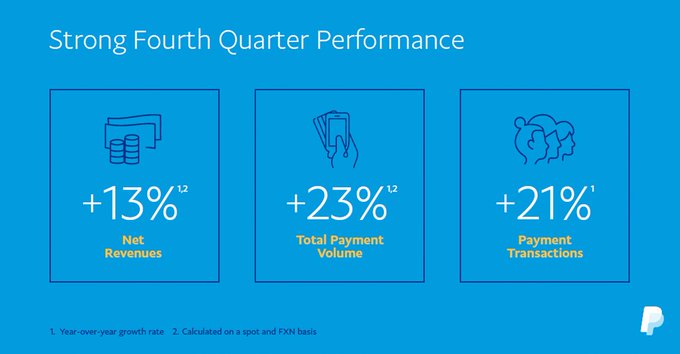

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

Changes To Cash App Reporting Threshold Paypal Venmo More

Fact Or Fiction You Ll Owe Taxes On Money Earned Through Paypal Cash App And Venmo This Year Cnet

Changes To Cash App Reporting Threshold Paypal Venmo More

Does Cash App Report To The Irs

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

10 Common Cash App Scams You Need To Know About In 2022

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

/cdn.vox-cdn.com/uploads/chorus_asset/file/19892770/Cash_App___Dollar___Full.jpg)

Square S Cash App Details How To Use Its Direct Deposit Feature To Access Stimulus Funds The Verge

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Personal Finance Blog